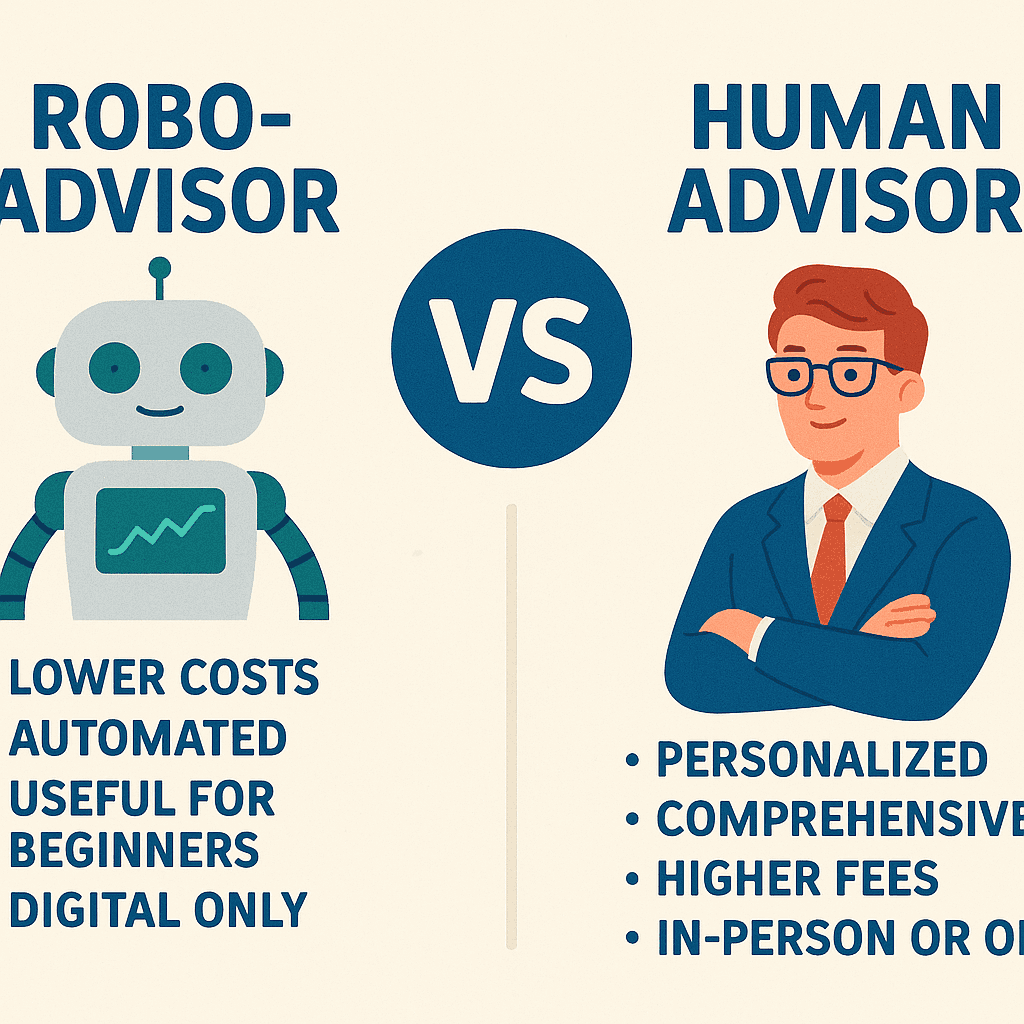

When managing your money, one of the first questions you’ll face is whether to work with a robo-advisor or a human advisor. As AI and automation become more mainstream in finance, many investors wonder whether they still need a real person—or whether an algorithm can handle it all.

Each option has distinct advantages depending on your income level, goals, investment style, and how much personal interaction you want. Let’s compare them side by side so you can decide what’s best for your unique situation.

What Is a Robo-Advisor?

A robo-advisor is an automated investment platform that uses algorithms to build and manage your portfolio. After answering a few questions about your goals and risk tolerance, the system allocates your funds into diversified investments—typically low-cost ETFs.

Popular robo-advisors include:

- Betterment

- Wealthfront

- SoFi Automated Investing

- Fidelity Go

- Schwab Intelligent Portfolios

They often include features like automatic rebalancing, tax-loss harvesting, and goal-based planning.

What Is a Human Advisor?

A human financial advisor is a licensed professional who provides personalized financial advice. This may include:

- Investment management

- Retirement planning

- Tax strategies

- Estate planning

- Life insurance and risk management

Advisors can work independently or be part of larger firms like Merrill Lynch, Vanguard Personal Advisor, or Edward Jones.

Robo-Advisor vs. Human Advisor: Quick Comparison Table

| Feature | Robo-Advisor | Human Advisor |

|---|---|---|

| Cost | 0.25%–0.50% annually | 0.75%–1.5% or flat fee |

| Personalization | Algorithm-based | Deeply tailored |

| Interaction | Online only | In-person or video calls |

| Emotional support | None | Available |

| Best for | Beginners, DIY investors | High-net-worth or complex needs |

| Minimum investment | $0–$500 | $50,000+ in many cases |

Advantages of Robo-Advisors

Low Fees

With fees around 0.25% per year, robo-advisors are far cheaper than traditional advisors. They also use low-cost ETFs, helping your portfolio grow faster.

Accessibility

You can open an account with no minimum balance or as little as $5. This makes them ideal for beginners or younger investors.

Automatic Rebalancing

Your portfolio is adjusted automatically as markets fluctuate, keeping you aligned with your risk profile without manual work.

Tax-Loss Harvesting

Some platforms (like Betterment or Wealthfront) automatically sell losing investments to offset gains, reducing your tax bill.

Ease of Use

You can manage your entire portfolio from a smartphone, track goals, and make deposits or withdrawals anytime.

Advantages of Human Financial Advisors

Deep Personalization

A human advisor considers every aspect of your financial life—from family needs and legacy goals to business planning and taxes.

Behavioral Coaching

During market crashes or economic uncertainty, a real advisor helps you avoid panic-selling or bad decisions.

Complex Situations

Advisors are valuable if you:

- Own a business

- Have international income or assets

- Need estate or trust planning

- Are planning for early retirement or college funding

Comprehensive Services

A financial advisor can coordinate with your CPA or attorney for a unified plan, something robo-advisors can’t do.

When to Choose a Robo-Advisor

Go with a robo-advisor if:

- You’re just starting to invest

- You want low-cost, hands-off investing

- Your goals are straightforward (retirement, saving for a home)

- You’re tech-savvy and don’t need emotional reassurance

- You value simplicity and automation

Robo-advisors are also a great secondary tool for experienced investors looking to automate a portion of their portfolio.

When to Choose a Human Advisor

Choose a human advisor if:

- You have over $250,000 to invest or complex finances

- You’re nearing retirement and need withdrawal strategies

- You want to create a tax-efficient estate plan

- You run a business and want strategic advice

- You want someone to hold you accountable and coach you emotionally

Even if you start with a robo-advisor, you may graduate to a human advisor as your finances become more complex.

Hybrid Solutions: The Best of Both Worlds?

Some services combine robo platforms with real advisors. These include:

- Vanguard Personal Advisor Services

- Betterment Premium

- Schwab Intelligent Advisory

- Ellevest Private Wealth

These offer algorithmic portfolio management with optional access to a real financial planner—usually for a slightly higher fee around 0.30%–0.50%.

This hybrid approach works well for those seeking convenience with occasional expert guidance.

Costs Comparison: Real Numbers

| Investment Value | Robo-Advisor Fee (0.25%) | Human Advisor Fee (1%) |

|---|---|---|

| $10,000 | $25/year | $100/year |

| $100,000 | $250/year | $1,000/year |

| $500,000 | $1,250/year | $5,000/year |

| $1,000,000 | $2,500/year | $10,000/year |

For those managing large sums, the cost difference becomes significant—unless personalized attention justifies the expense.

Security and Trust

Both robo and human advisors operate under strict regulatory oversight. Most use custodians like Charles Schwab or Fidelity and are insured by SIPC. However:

- Robo-advisors rely on digital security only

- Human advisors may offer fraud alerts or help recover lost access

Make sure any advisor—human or automated—is Fiduciary, meaning they’re legally required to act in your best interest.

Final Thoughts

When deciding between a robo-advisor or a human advisor, the right choice depends on your financial goals, comfort level, and life stage.

Robo-advisors are ideal for low-cost, efficient investing, especially for new or passive investors. Human advisors shine when your finances become more intricate—or when you want someone in your corner during life’s curveballs.

You don’t have to pick one forever. Many investors start with robo-advisors, then upgrade to human advisors as their wealth and goals evolve.