Buying a home has always been a major milestone. But if you’re self-employed or earning your income through gig work, the process can feel a lot more complicated. The rules are different, the paperwork is heavier, and traditional lenders might raise an eyebrow the moment they hear the word “freelancer.”

But here’s the good news—mortgages for self-employed and gig workers are absolutely possible in 2025. You just need to know how to present your finances in the right light.

Let’s walk through what lenders look for, what documents you need, and how to boost your approval odds without a traditional paycheck.

Why It’s Harder for Self-Employed Borrowers

Most mortgage lenders love predictability. That’s why W-2 employees with a steady salary often have an easier time getting approved. Their income is simple to verify and seems “less risky.”

As a freelancer, business owner, or gig worker, your income might:

- Fluctuate from month to month

- Come from multiple sources

- Include cash or 1099 income

- Lack employer-provided benefits

Lenders want reassurance that your income is both consistent and sufficient—even without the standard paystubs.

Who Qualifies as Self-Employed or Gig Worker?

Lenders usually categorize you as self-employed if you:

- Own 25% or more of a business

- Are a freelancer, consultant, or independent contractor

- Drive for Uber, DoorDash, or similar gig apps

- Run a sole proprietorship or LLC

- Operate as a full-time creator or digital nomad

If you’re not receiving a regular W-2 salary, you’ll be expected to show a different kind of paper trail.

Key Requirements for a Mortgage in 2025

Most lenders still follow these basic rules, whether you’re self-employed or not:

- Minimum credit score: 620 (but aim for 700+ for best rates)

- Debt-to-income ratio (DTI): Below 43% preferred

- Stable income history: Ideally 2+ years in the same field

- Down payment: 3%–20% depending on the loan type

The biggest difference for gig workers lies in how you document your income.

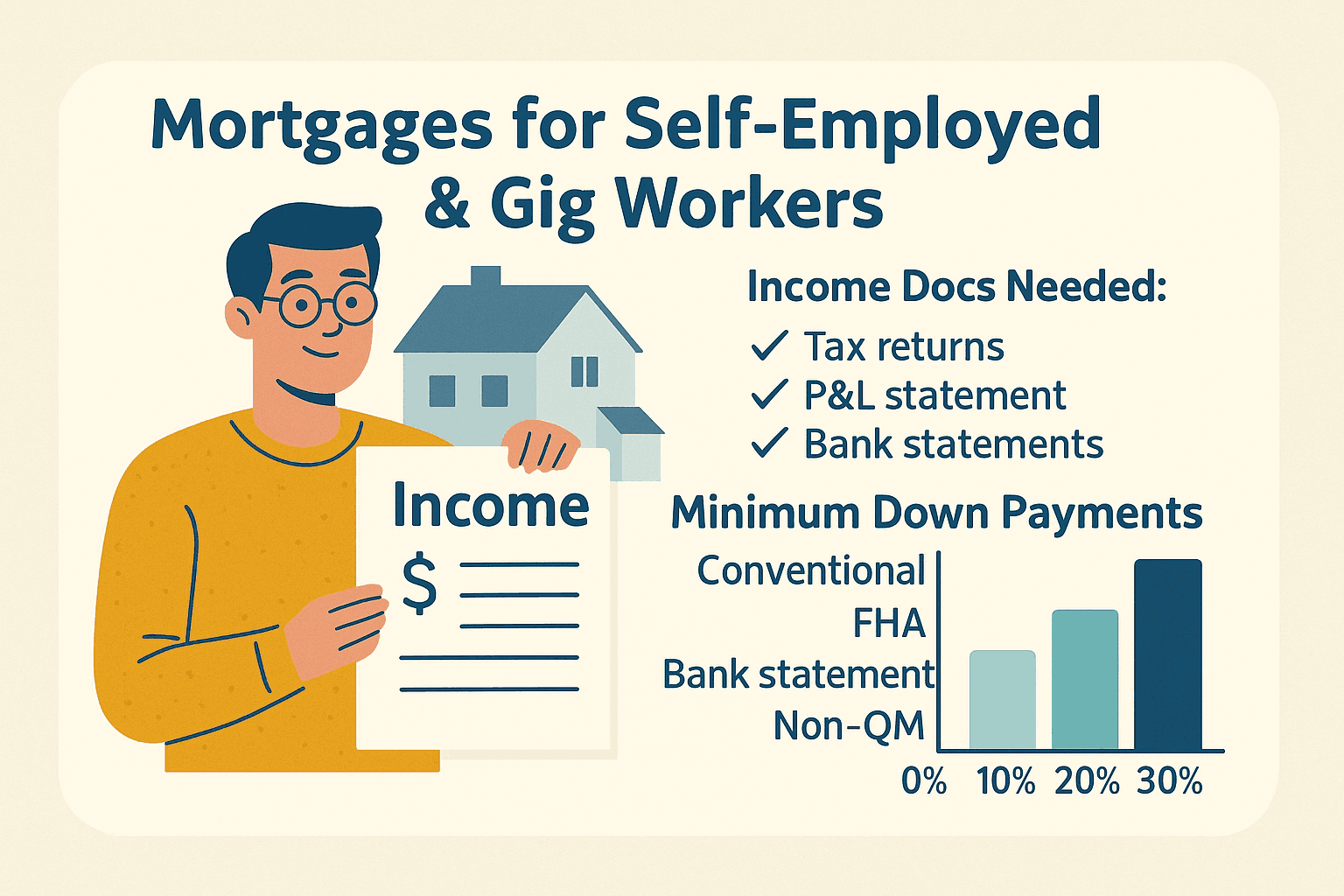

Documents You’ll Need as a Self-Employed Borrower

To apply for a mortgage without a W-2, expect to provide:

- Two years of personal tax returns (Form 1040)

- Two years of business tax returns (if applicable)

- Year-to-date profit and loss (P&L) statement

- Bank statements (business and personal)

- Client contracts or invoices (if helpful)

- A letter from your CPA verifying your income or business status

If your income dropped during the pandemic and recovered, be ready to explain why and how things stabilized.

Table: Traditional vs. Self-Employed Mortgage Requirements

| Requirement | Traditional Employee | Self-Employed/Gig Worker |

|---|---|---|

| Income Proof | Pay stubs, W-2s | Tax returns, P&L, bank statements |

| Income Type | Fixed salary | Variable/self-reported |

| Verification | Simple | More detailed |

| Risk Profile | Low | Higher (to lenders) |

| Documentation | Minimal | Extensive |

Top Mortgage Options for Self-Employed & Gig Workers

1. Conventional Loans (Fannie Mae / Freddie Mac)

- Require 2 years of self-employment history

- Use tax returns to verify income

- May allow 1 year of returns if you’ve been in the same line of work for longer

2. Bank Statement Loans

- Use 12–24 months of business/personal bank statements instead of tax returns

- Great for those who write off a lot of expenses

3. Non-QM (Non-Qualified Mortgages)

- Designed for borrowers outside traditional lending rules

- Allow higher DTI ratios, recent credit issues, or unique income streams

4. FHA Loans

- More lenient credit and down payment requirements

- Still require thorough income documentation

5. DSCR Loans (For Investors)

- Based on property cash flow rather than personal income

- Ideal for real estate investors or landlords

Bar Chart: Minimum Down Payments by Loan Type

| Loan Type | Min Down Payment |

|---|---|

| Conventional | 3%–5% |

| FHA | 3.5% |

| Bank Statement | 10%–20% |

| Non-QM | 10%–30% |

| DSCR | 20%+ |

How to Strengthen Your Mortgage Application

Boost Your Credit Score

Pay down credit cards, correct errors on your report, and avoid new hard inquiries before applying.

Lower Your DTI

Keep debts like auto loans or personal loans low. More income and fewer debts improve your approval odds.

Save for a Larger Down Payment

Putting 10%–20% down reduces lender risk and can improve your rate.

Show Consistency

If you freelance or drive for Uber, show 12+ months of steady or growing income. Bonus points for organized records.

Organize Your Records

Keep clean, professional bookkeeping. Use software like QuickBooks or Wave to generate reliable P&Ls.

Work with a Mortgage Broker Who Gets It

Not every lender understands gig income. Find a broker who specializes in self-employed or non-QM loans.

What If You’re Newly Self-Employed?

If you’ve been self-employed less than two years, getting a mortgage is harder—but not impossible.

Lenders may consider:

- Your work history in the same field

- Bank statement loans

- A co-signer or spouse with stable W-2 income

You may need to wait until you’ve filed at least one full year of tax returns showing strong income.

Final Thoughts

Getting a mortgage when you’re self-employed or working gig jobs isn’t impossible—it just takes more paperwork, patience, and preparation.

With the right lender, a clean record, and strong documentation, you can absolutely qualify and lock in competitive rates. Don’t let your non-traditional income stop you from owning a home.

Be organized, be honest, and be ready to show lenders that while you don’t have a boss, you do have a reliable income.