If you’ve ever had a strange charge appear on your bank statement, received a credit card you didn’t apply for, or gotten a notice about a data breach—welcome to the club. In today’s digital world, identity theft isn’t rare—it’s expected. In 2025, nearly 1 in 3 Americans report some form of identity fraud attempt.

So it’s no surprise that “identity theft protection” has become big business. Companies like LifeLock, Aura, and IdentityForce advertise peace of mind for a monthly fee. But do these services actually help? And more importantly—is identity theft protection worth paying for, or can you defend yourself just as well for free?

Let’s break it down.

What Is Identity Theft?

Identity theft is when someone steals your personal information—like your Social Security number, bank credentials, or credit card data—and uses it for fraud. That could mean:

- Opening credit cards in your name

- Taking out loans you’ll never see

- Filing fake tax returns for your refund

- Draining your bank accounts

- Committing crimes using your identity

In 2025, the most common types are:

- Credit card fraud (33%)

- Government benefits fraud (24%)

- Loan or lease fraud (16%)

- Bank account takeover (14%)

And these are rising due to AI-powered phishing scams, dark web leaks, and synthetic identity creation.

What Identity Theft Protection Services Actually Do

Most paid identity theft services offer a mix of the following:

Credit Monitoring – Alerts you to changes in your credit report (new accounts, inquiries, delinquencies)

SSN Monitoring – Scans the web and dark web for misuse of your SSN

Bank & Transaction Monitoring – Flags unusual activity on linked financial accounts

Identity Recovery Assistance – Helps you restore your identity if compromised

Insurance Coverage – Pays legal fees, lost wages, and recovery costs (up to $1M)

Lost Wallet Protection – Helps you cancel and replace stolen cards and IDs

Premium plans may include antivirus tools, password managers, and VPNs.

Pros of Paying for Protection

Early Detection Saves Time & Money

Getting alerted the moment someone applies for credit in your name gives you a head start in stopping the fraud.

Dedicated Recovery Help

If your identity is stolen, services like IdentityForce assign you a case manager who deals with banks, creditors, and even the IRS for you.

Reimbursement Coverage

If fraud causes financial loss, many plans reimburse you for legal fees, lost income, childcare, and travel costs.

Peace of Mind

Just like you pay for health or car insurance, you’re paying for support if something bad happens.

Cons of Paying for Identity Protection

They Don’t Prevent Theft

No service can guarantee prevention. They alert you after something happens—not before.

Much of It You Can Do Yourself—for Free

You can set up free alerts, freeze your credit, and monitor your accounts without a subscription.

Monthly Fees Add Up

Most services cost $10–$30 per month—or more for family plans.

Free Ways to Protect Yourself

Freeze Your Credit

This stops anyone from opening new credit lines in your name. It’s free to do at all three major bureaus: Equifax, Experian, and TransUnion. You can unfreeze it anytime.

Set Up Credit Alerts

Use free services like Credit Karma, Experian, or Credit Sesame. They’ll alert you about changes to your score, new inquiries, or account openings.

Use Strong, Unique Passwords

Don’t reuse passwords across accounts. Use a free password manager like Bitwarden or LastPass (basic tier) to manage your logins securely.

Monitor Your Bank & Credit Accounts Weekly

Look for strange transactions, duplicate charges, or unfamiliar merchant names. Most mobile banking apps allow daily notifications and instant alerts.

Check Your Full Credit Reports

Go to AnnualCreditReport.com and pull all three reports once every 12 months (free by law). Look for accounts you didn’t open, incorrect addresses, or unexpected hard inquiries.

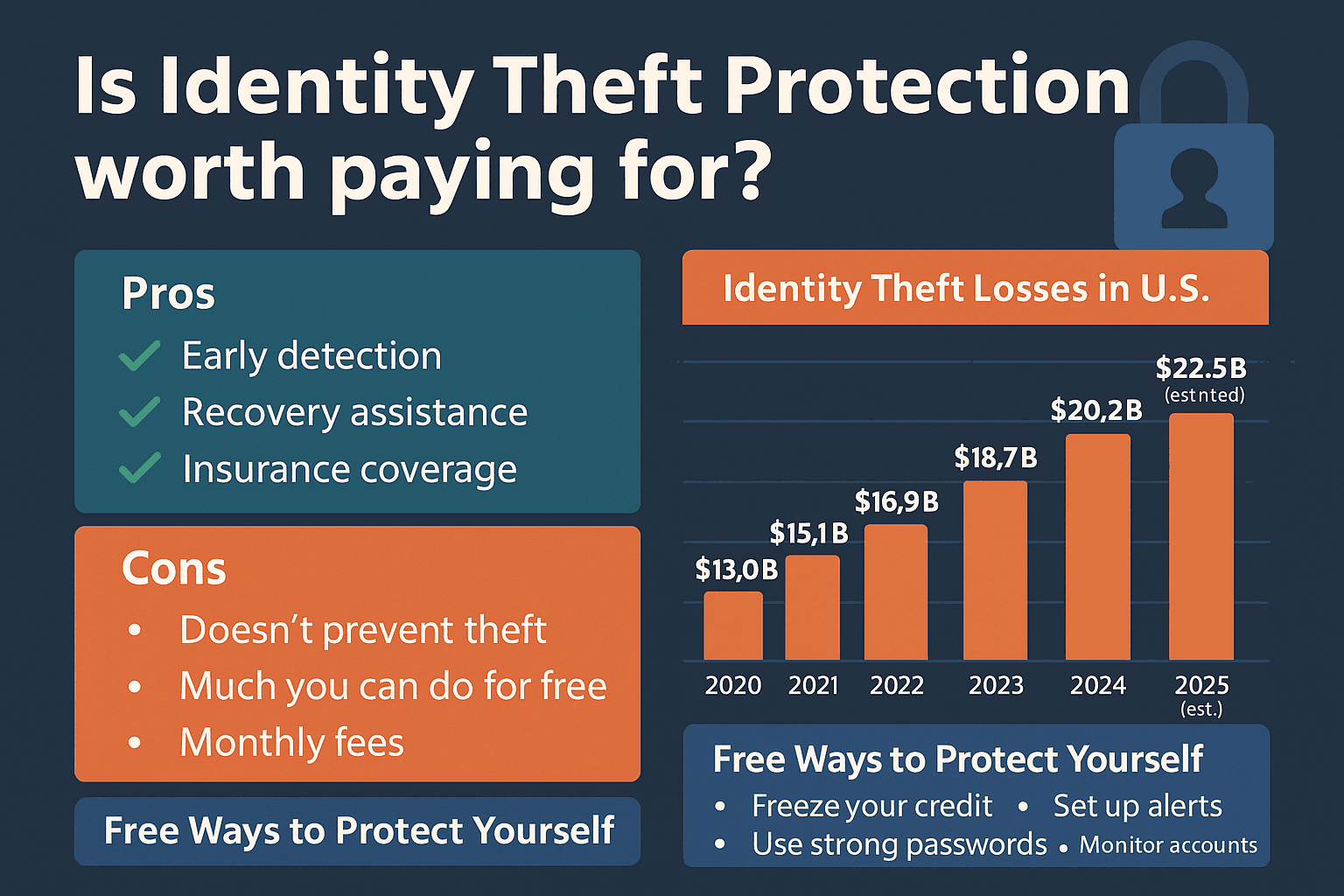

Identity Theft Losses in the U.S. (2020–2025) – Bar Chart

2020 – $13.0B

2021 – $15.1B

2022 – $16.9B

2023 – $18.7B

2024 – $20.2B

2025 – $22.5B (estimated)

Source: FTC, Identity Theft Resource Center

Who Should Consider Paying?

Identity theft protection may be worth it if you:

- Recently had your data compromised in a breach

- Have high net worth or multiple credit lines

- Don’t have time to monitor everything yourself

- Are a caregiver managing others’ accounts

- Travel frequently or use public Wi-Fi often

Bundled family plans can also include child ID monitoring, which helps protect against long-undetected child identity theft.

Final Thoughts

So is identity theft protection worth it? It depends on your risk level, lifestyle, and how proactive you want to be.

If you have the time and discipline to monitor your finances closely, you can replicate much of what these services do. But if the idea of 24/7 monitoring, insurance coverage, and help with recovery brings peace of mind—it might be money well spent.

Just remember: no service replaces good habits. Stay alert, check your accounts regularly, and act fast if anything feels off.