If you’re planning ahead for college costs, you’ve probably heard about 529 plans and Roth IRAs as smart ways to save. But which is better? And does one option lock you in while the other gives you more flexibility?

In 2025, the rules around education savings accounts have evolved—but the same question still matters: What’s the best way to save for a child’s (or your own) education—529 College Savings Plan or Roth IRA?

Let’s break it down with real comparisons, updated regulations, and practical tips to help you decide.

What Is a 529 College Savings Plan?

A 529 plan is a tax-advantaged savings account specifically for education expenses. While contributions are made with after-tax dollars, the earnings grow tax-free, and withdrawals are also tax-free if used for qualified education expenses.

Key features of a 529 Plan:

- No income limits

- Contributions may be state tax deductible

- Funds can be used for K–12 tuition (up to $10,000/year)

- Can be transferred to another beneficiary (like a sibling)

- Starting in 2024, up to $35,000 of leftover 529 funds can be rolled into a Roth IRA (if certain conditions are met)

Eligible expenses include:

- College tuition and fees

- Room and board

- Books and supplies

- Some apprenticeship programs and student loan payments

What Is a Roth IRA?

A Roth IRA is typically a retirement account, but it also has benefits for education savings. You contribute after-tax income, and your investments grow tax-free. While you generally can’t touch Roth IRA earnings before age 59½, you canwithdraw your contributions at any time, and use earnings for education—with fewer penalties.

Key Roth IRA education-related benefits:

- Withdraw contributions anytime, for any reason

- Withdraw earnings penalty-free for qualified education expenses (though they are subject to income tax)

- No required withdrawals ever

- More flexibility if the child doesn’t attend college

Roth IRAs are especially useful for families who want to keep their options open—education, retirement, or even a down payment on a home.

Key Differences at a Glance

| Feature | 529 Plan | Roth IRA |

|---|---|---|

| Tax-Free Growth | ✅ Yes | ✅ Yes |

| Withdrawals for College | ✅ Tax-free for qualified expenses | ✅ Tax-free on contributions; taxes on earnings |

| Withdrawals for Non-College | ❌ 10% penalty + income tax on earnings | ✅ Contributions anytime; earnings taxed + 10% penalty (unless exception) |

| Income Limits | ❌ None | ✅ Yes (phases out around $153K–228K for couples in 2025) |

| Financial Aid Impact | Low (parent-owned) | Low (student-owned may reduce aid) |

| Flexibility | Moderate | High |

| State Tax Deductions | ✅ In many states | ❌ None |

| K-12 Tuition Eligible | ✅ Yes (up to $10K/year) | ❌ Not eligible |

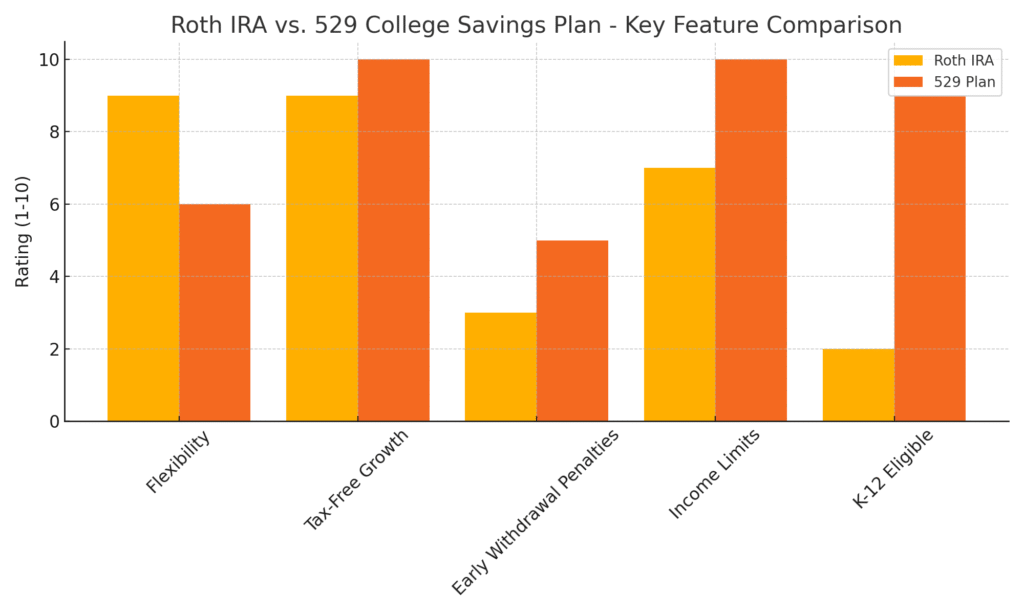

Visual Comparison: Roth IRA vs. 529 Plan

Here’s how each ranks on core features (rated 1–10):

Bar Chart:

Roth IRA vs. 529 College Savings Plan – Key Feature Comparison

- Flexibility: Roth IRA (9), 529 Plan (6)

- Tax-Free Growth: Roth IRA (9), 529 Plan (10)

- Early Withdrawal Penalties: Roth IRA (3), 529 Plan (5)

- Income Limits: Roth IRA (7), 529 Plan (10)

- K-12 Eligible: Roth IRA (2), 529 Plan (9)

When to Use a 529 Plan

529 plans shine when:

- You’re certain the funds will be used for education

- You want to benefit from state tax deductions

- You want to use savings for K–12 or apprenticeships

- You plan to contribute more than the Roth IRA annual limit ($7,000 for 2025)

- You want to name different beneficiaries (child 1, then 2, then grandchild)

When to Use a Roth IRA

A Roth IRA is a great education savings tool when:

- You’re not sure if the child will go to college

- You want dual-purpose savings (retirement + education)

- You’re self-employed or don’t have access to employer retirement plans

- Your income is under the Roth contribution limit

Pro Tip: Parents often open a Roth IRA in their name—not the child’s—so they retain full control and flexibility.

Can You Use Both?

Absolutely. Many families use both accounts:

- Use the Roth IRA for flexible savings and as a backup

- Use the 529 plan for predictable education expenses

Just remember: the Roth IRA contribution limit is lower ($7,000/year for 2025; $8,000 if over age 50), while the 529 allows much higher contributions (some plans allow up to $350,000–$500,000 lifetime).

New Rule Spotlight (2025): Roth Rollover from 529

Beginning in 2024, you can roll over up to $35,000 from a 529 plan to a Roth IRA in the beneficiary’s name, provided:

- The 529 account is at least 15 years old

- The funds have been in the account for 5+ years

- Rollovers count toward the annual Roth IRA contribution limit

This means leftover funds in a 529 don’t have to go to waste—they can jumpstart retirement savings.

Final Thoughts

So which one should you pick in 2025?

If you’re focused solely on education, a 529 is hard to beat for its tax advantages and growing flexibility. But if you value multi-use flexibility, especially if college isn’t a sure thing, a Roth IRA gives you options without penalties.

In reality, the smartest families often use both—layering flexibility with tax advantages to prepare for education and retirement.

Whatever you choose, start early, stay consistent, and take advantage of every dollar the tax code allows you to save.