Side hustles aren’t just for extra income anymore—they’re how millions of Americans build businesses, cover bills, and transition to full-time self-employment. But if you’re not claiming your eligible tax write-offs, you could be leaving serious money on the table.

From freelance graphic design to rideshare driving or running an Etsy shop, side gigs come with plenty of costs. Luckily, the IRS lets you deduct many of them—legally reducing your taxable income.

Let’s walk through the smartest side hustle tax deductions you need to know in 2025, so you keep more of your hard-earned cash.

Why Tax Deductions Matter

When you work a regular job, your employer withholds taxes and you receive a W-2. But with a side hustle or freelance income, you’re responsible for:

- Self-employment tax (Social Security & Medicare)

- Federal and possibly state income tax

- Quarterly estimated payments

This can easily eat up 30%–40% of your income if you’re not deducting business expenses properly.

Every dollar you deduct legally reduces your taxable income, which means you owe less in April.

Who Can Claim Side Hustle Deductions?

You can deduct business expenses if you earn income from:

- Freelance or contract work (1099-NEC or 1099-K)

- Selling products on Etsy, Amazon, eBay, or Shopify

- Providing local services (photography, tutoring, landscaping, etc.)

- Gig economy jobs (Uber, DoorDash, Instacart)

- Online income like blogging, YouTube, or affiliate marketing

If you’re making money from any self-employed activity, you’re considered a business owner in the eyes of the IRS—even if it’s part-time.

Top Tax Deductions Side Hustlers Can Claim

1. Home Office Deduction

If you use part of your home exclusively and regularly for your business, you can deduct:

- A portion of rent or mortgage interest

- Utilities

- Internet

- Depreciation

There are two options:

- Simplified method: $5 per square foot (up to 300 sq ft)

- Actual expense method: Deduct percentage based on workspace size

2. Mileage and Vehicle Expenses

If you use your personal vehicle for business (client meetings, deliveries, etc.), track your mileage.

- Standard mileage rate (2025): Estimated at 65.5 cents per mile

- Or deduct actual expenses: gas, maintenance, insurance, lease payments (based on % of business use)

Use apps like MileIQ or Everlance to track automatically.

3. Supplies and Equipment

You can deduct:

- Laptops, phones, or tablets used for business

- Cameras, tools, printers, etc.

- Office supplies like paper, pens, storage

If an item is used for both personal and business use, only deduct the portion used for business.

4. Software and Subscriptions

Anything you pay for to run your business:

- Canva Pro, Adobe Suite

- QuickBooks, FreshBooks

- Scheduling tools (Calendly, Dubsado)

- Email marketing tools (ConvertKit, Mailchimp)

- Cloud storage (Dropbox, Google Drive)

If it helps you do your work, it’s probably deductible.

5. Marketing and Advertising

This includes:

- Facebook or Google ads

- Promoted Instagram posts

- Business cards, flyers, branded swag

- Website hosting and domain fees

Every dollar spent to bring in new clients is usually a valid business expense.

6. Education and Training

If it directly relates to your hustle, you can deduct:

- Online courses

- Business books

- Coaching sessions

- Industry-specific certifications

It must maintain or improve your current skills (not prepare you for a new career).

7. Phone and Internet

You can deduct a percentage of your phone and internet bill if they’re used for work.

For example:

- 70% business use of your phone = 70% deductible

- Internet used for video calls, uploads, client emails = partially deductible

Just document your usage pattern in case of an audit.

8. Health Insurance (if self-employed full-time)

If you don’t have employer coverage and pay your own premiums, you may deduct the cost above the line (even if you don’t itemize).

Other Less-Common Deductions

- Business meals (50% deductible)

- Bank fees or PayPal processing fees

- Travel related to gigs (hotels, airfare)

- Legal or accounting fees

- Business insurance

- Co-working space fees

- Depreciation on expensive assets

Table: Most Common Side Hustle Tax Write-Offs

| Category | Deductible? | Notes |

|---|---|---|

| Laptop for design work | ✅ Yes | Partial if personal use too |

| Instagram ads | ✅ Yes | Fully deductible |

| Home office (bedroom) | ✅ Yes | Must be exclusive use |

| Meals with clients | ✅ 50% | Must be business related |

| Netflix subscription | ❌ No | Not business-related |

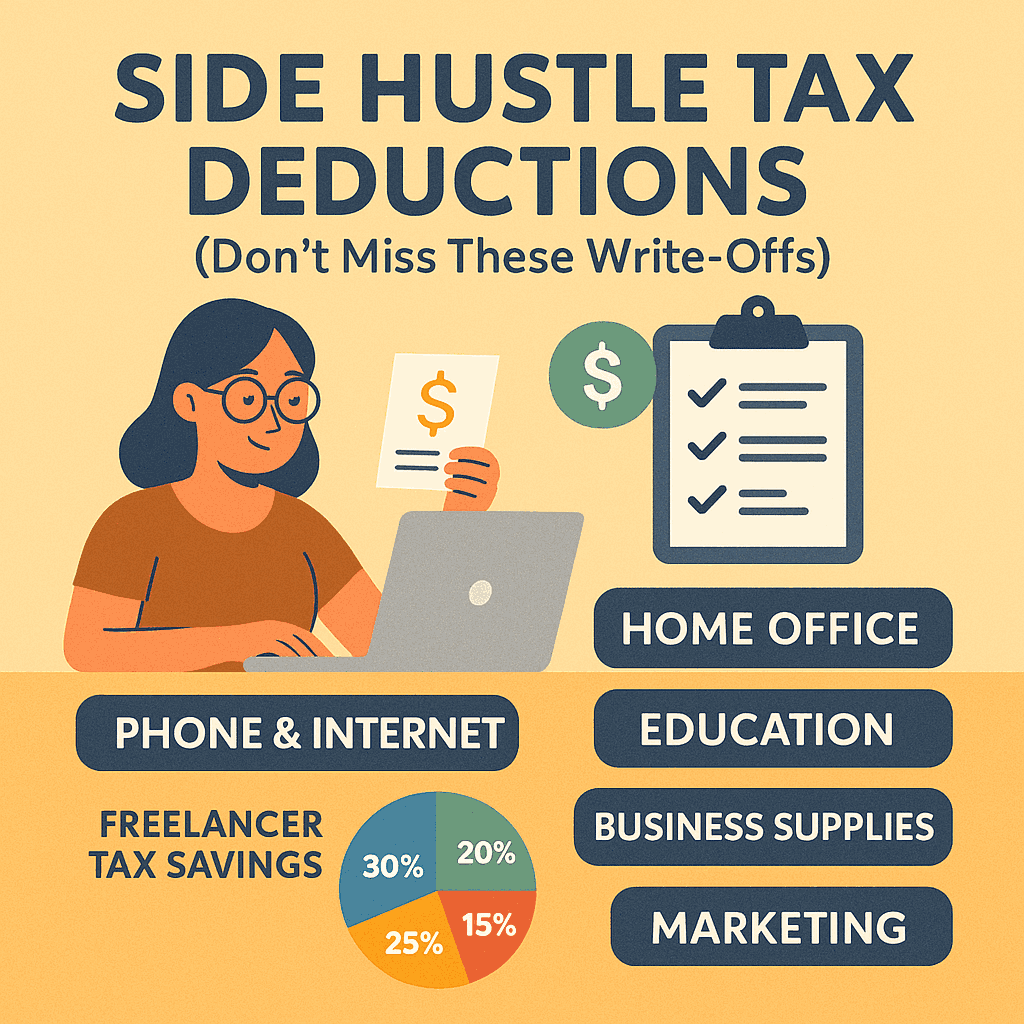

Pie Chart: Where Most Freelancers Save on Taxes

diffCopyEdit- 30% Home Office + Utilities

- 25% Internet, Phone, Software

- 20% Travel & Vehicle Use

- 15% Marketing & Subscriptions

- 10% Misc. (bank fees, coaching, books)

Tracking all of these expenses can lead to thousands in deductions annually.

What About Hobby Income?

If your side gig is something you do casually (e.g., selling crafts once in a while), it may be considered a hobby, not a business.

Hobby income is still taxable, but you can’t deduct expenses. To be considered a real business, the IRS looks for signs like:

- Intent to make a profit

- Regular effort and business structure

- Consistent revenue

If you treat it like a business, track it like one.

Tools to Stay Organized

- QuickBooks Self-Employed – Auto-categorizes expenses, tracks mileage

- Wave – Free accounting software for freelancers

- Keeper Tax – Finds hidden deductions

- Notion or Google Sheets – DIY tracking if you prefer simplicity

Final Thoughts

Running a side hustle means you have more financial freedom—but also more tax responsibility. The good news? You can offset a lot of that by knowing your deductions.

From your internet bill to your car mileage to the Canva subscription you use for content, these are real business expenses—and they deserve to be claimed.

Start tracking now. Save receipts. Use tech to help. And when in doubt, consult a tax professional.

Because when you know what you can write off, you don’t just hustle harder—you hustle smarter.