Buy Now, Pay Later vs. Credit Cards: What’s Better in 2025? In 2025, payment options are more flexible than ever. At checkout, you’re no longer just pulling out a Visa…

Budgeting with AI and Fintech Tools: Smarter Money Management in 2025 In 2025, budgeting with AI and fintech tools isn’t just for techies. It’s the new normal. Whether you’re tracking daily expenses…

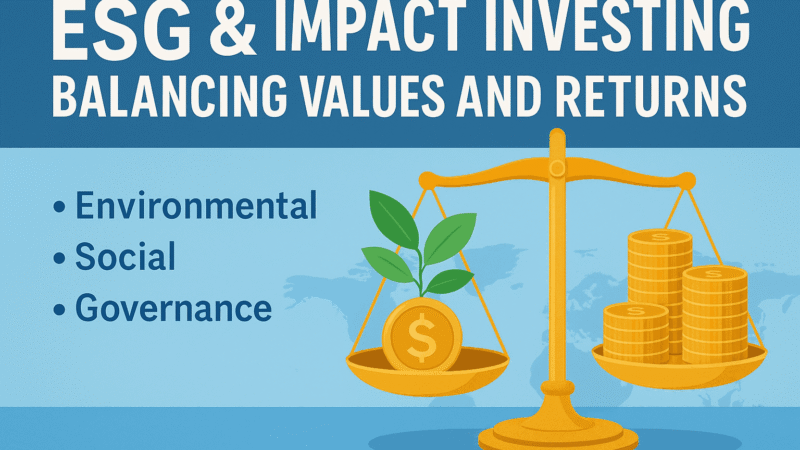

ESG & Impact Investing in 2025: Align Your Money with Your Values ESG & Impact Investing are more than trends in 2025—they are reshaping how Americans build wealth. Investors are no…

If you’re planning ahead for college costs, you’ve probably heard about 529 plans and Roth IRAs as smart ways to save. But which is better? And does one option lock…

If you’re carrying student loans in 2025, chances are you’ve seen headlines about forgiveness programs, payment pauses, and refinancing offers. But what’s really best for your wallet? Should you stick…

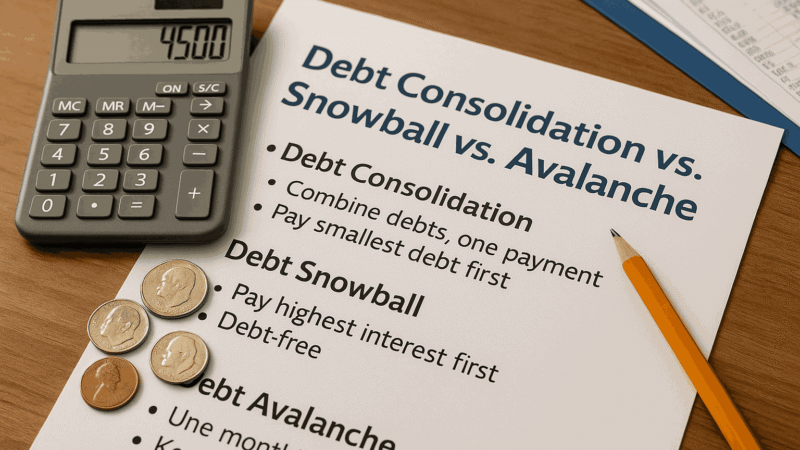

If you’ve got multiple debts—credit cards, personal loans, or medical bills—you’re not alone. The average American carries over $6,000 in credit card debt alone, and many juggle several payments at…

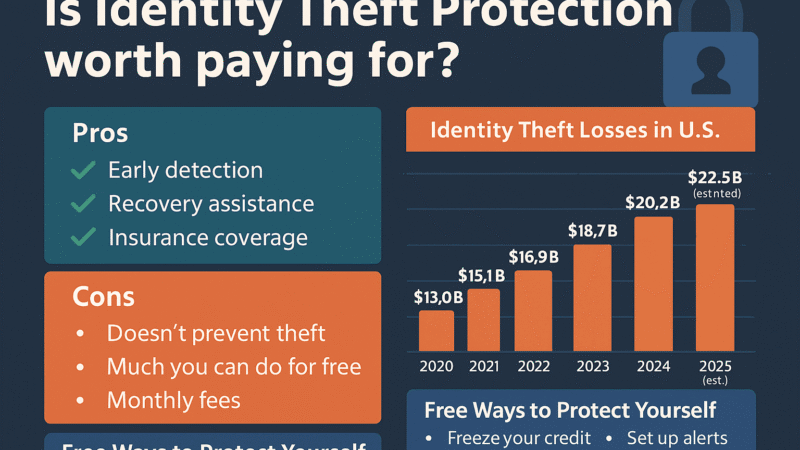

If you’ve ever had a strange charge appear on your bank statement, received a credit card you didn’t apply for, or gotten a notice about a data breach—welcome to the…

If you’ve already paid your bills on time and kept your credit utilization low—great. But what if you want to push your score from good to excellent? Maybe you’re trying to qualify for…

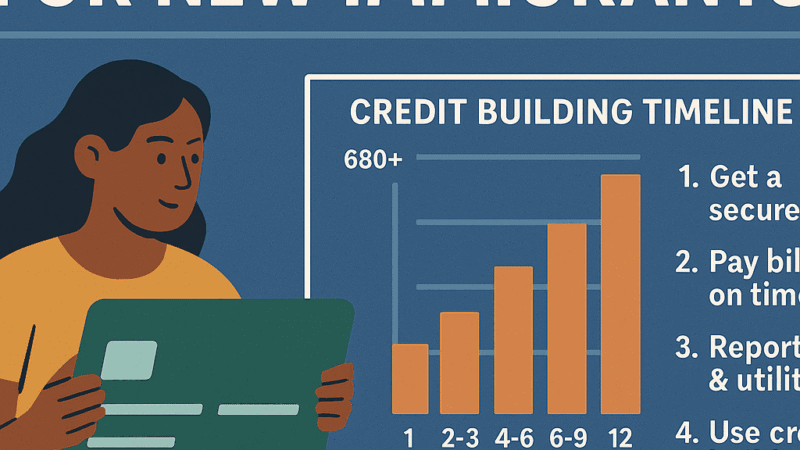

Moving to the U.S. is a big step—and for many, one of the most confusing parts isn’t language, laws, or culture. It’s credit. Without a U.S. credit history, it’s hard…

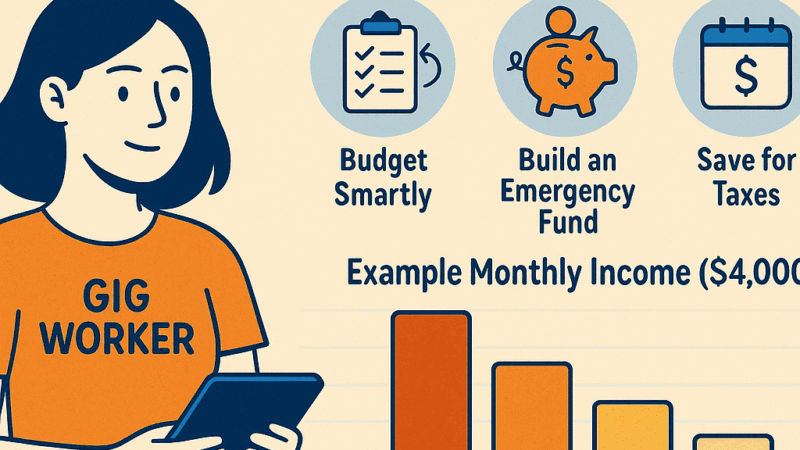

For gig workers and freelancers, one month can feel like a financial windfall—and the next like you’re scrambling just to cover rent. If you’ve ever stressed about how to handle…